Southern Europe’s online gambling sector is shifting quickly. Both countries want safer, more controlled environments, but their approaches show how differently governments can respond to the same challenges.

In Italy, regulators are rebuilding the system from the ground up. In Portugal, lawmakers are wrestling with the balance between industry growth and responsible oversight. These divergent decisions reveal two contrasting visions for the future of regulated gambling.

Italy’s Drastic Market Consolidation

Italy’s market changed almost overnight after the new regulatory framework was introduced in late 2025. The Customs and Monopolies Agency, known as ADM, created a reset that forced the entire sector to reorganise. Operators who once relied on long lists of joint domains no longer have that option.

The new rule is simple. One license means one domain. This alone cuts the active list from more than 400 sites to just 52. The aim is to reduce clutter and concentrate the market into a space that regulators can supervise with more confidence.

The steep cost of entry reinforces that objective. A nine-year license now costs €7 million, pushing smaller operators toward closure or merger. Italy wants a market built around stability rather than volume and only financially resilient companies can remain.

This consolidation reshapes how the whole sector operates. Large operators now focus more on quality, reliability and trust, which regulators hope will create a calmer digital environment than the fragmented ecosystem of previous years.

What Players Can Expect In a Tighter System

A more controlled market changes how services look and feel. With fewer licensed operators, the companies that remain must compete through value and experience, not quantity. Many are improving customer support, refining interfaces and simplifying navigation because loyal players now matter more than a long list of skins.

Promotional practices are also evolving. For example, some top-tier brands still use familiar tools such as no deposit free spins, but these offers are now part of a more curated approach rather than a mass-marketing push. Within the new framework, bonuses are defined with more precision and serve more as product trials than as aggressive acquisition tactics.

The sign-up process is stricter as well. Italy now requires identification through the SPID digital identity system or an electronic ID card. It adds friction, but the goal is stronger protection and fewer loopholes that previously allowed underage access or impersonation. The system may feel firm, yet it creates a more secure environment for every legitimate user.

Portugal’s Fight Over Advertising Visibility

While Italy focuses on consolidation, Portugal is debating how much visibility gambling should have. The country saw a 9.6% revenue increase in the second quarter of 2025, strengthening the industry’s presence. That growth, however, triggered new political pressure for stricter limits.

Several left-leaning parties want much tighter rules, including bans on gambling ads during daytime hours or on social media via influencers. Supporters argue that these measures protect families from constant exposure. Opponents insist that responsible advertising helps consumers identify which sites are licensed and which are not.

This clash has turned the parliament into a battleground between those who want a modernised, clearly identifiable market and those who prioritise public health concerns. The outcome will decide how visible betting companies remain in Portuguese media and whether the current open-market model becomes more restrictive.

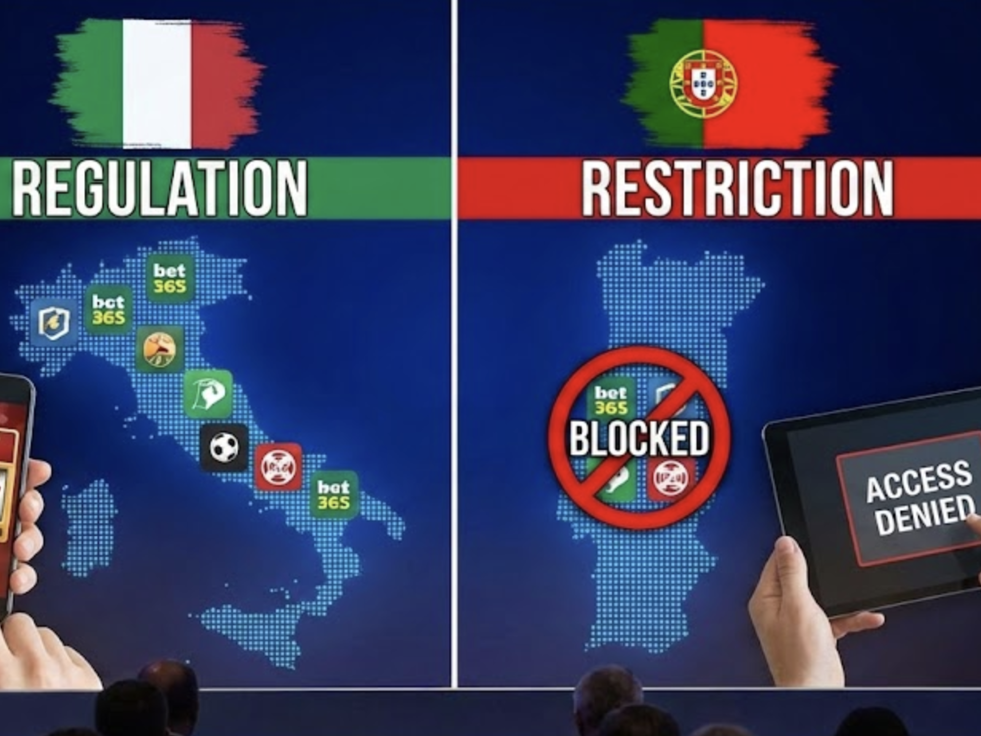

Each Country Confronts the Black Market Differently

Although Italy and Portugal disagree on advertising and licensing, both face the same threat from unregulated operators. Their strategies differ because their systems are built on different foundations.

Italy leans on technical enforcement. Payment blocks, domain blocks and financial thresholds aim to shrink the space where illegal platforms can operate. A smaller, more clearly defined market is easier to police.

Portugal’s challenge is more complicated. If advertising is overly restricted, licensed brands risk losing visibility, which may unintentionally push consumers toward unsafe offshore platforms. Industry leaders warn that without clear signals that identify legitimate sites, unregulated operators become harder to spot.

Both countries do agree on one thing. Sharing information on illegal activity is essential and cooperation across borders is increasing.

What 2025 Means for the Future

This year marks a decisive moment for both nations. Italy has effectively locked its structure for almost a decade. Unless future governments revisit the financial requirements, the list of approved operators will remain small and stable. Debates in Italy will likely shift from access to topics such as sponsorship rules and player protection tools.

Portugal’s direction is still unsettled. The outcome of its ongoing legislative debates will influence the next decade of regulation. If strict advertising limits pass, the sector may contract or shift to less visible channels. If modernisation efforts win, Portugal could maintain an open, transparent market with stronger social safeguards.

In the end, the two countries represent competing models. Italy is building a fortress designed around stability and clarity. Portugal is experimenting with how to regulate a fast-growing sector without suppressing it entirely. The coming years will reveal whether tight control or flexible adaptation produces a healthier, more sustainable landscape for Europe’s online gaming industry.