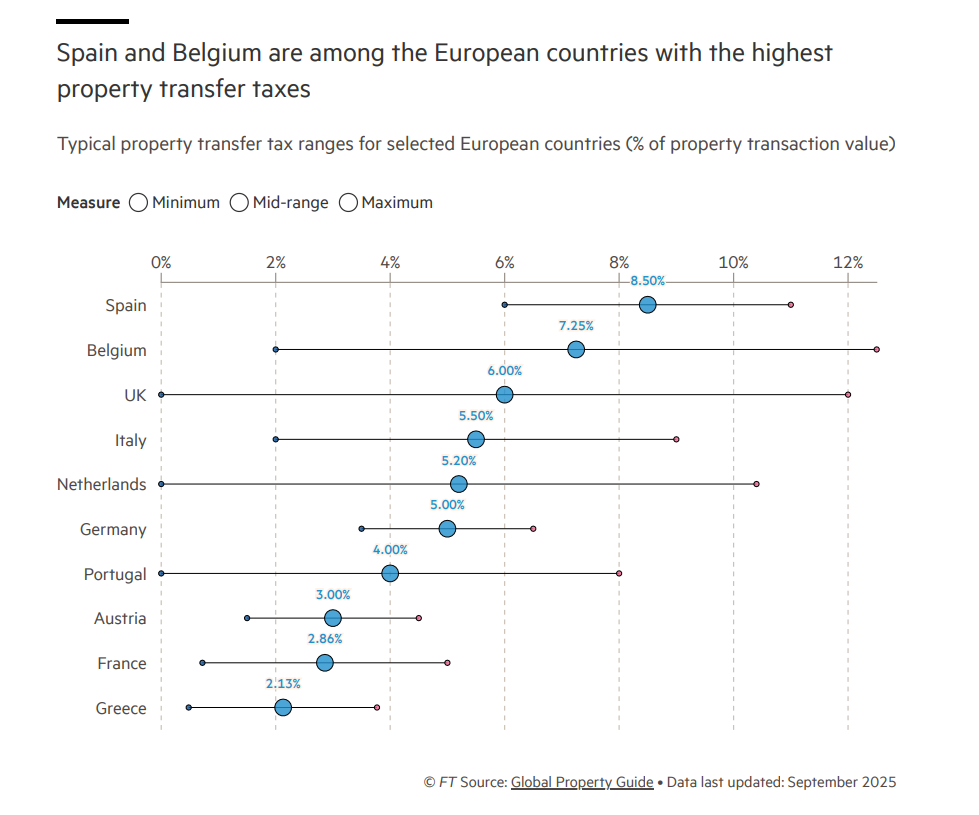

Some areas of Spain and Belgium are the most expensive in terms of taxes, while in certain regions of Switzerland, buyers pay nothing, according to a Financial Times study. In Portugal, young people up to 35 years old also pay no taxes on the purchase of their first permanent home.

According to the same study, purchasing a 300,000-euro home in the European Union would result in a transfer tax of 30,000 euros or more in the Valencian Community, Catalonia, or Belgium. In Zurich, despite having some of the most expensive homes in the world, buyers do not pay this tax due to a 2005 law aimed at encouraging more real estate transactions.

Portugal

Among the European countries analysed, Portugal has the seventh-highest average housing transaction tax rate (4%), in a list in which Spain ranks first (8.5%). In Portugal, taxes payable on home purchases can range from zero to 8%. This is because young people up to 35 years old currently have access to exemptions from IMT and Stamp Duty when purchasing their own permanent home.

In the United Kingdom, the progressive wealth transfer tax in England and Northern Ireland, known as stamp duty, implies a 5% surcharge for those who already own a home, raising the maximum rate to 17% for homes over £1.5 million.

Angela Rayner, the former Deputy Prime Minister, recently resigned after admitting not having paid this "surcharge" on a second property. On the other hand, first-time home buyers up to £300,000 pay no tax, and a reform of stamp duty is being discussed to encourage mobility and introduce alternatives such as a mansion tax.

Spain

In Spain, property transfer taxes are not levied by the central government, but by the 17 autonomous communities. The highest rates are in Catalonia and the Valencian Community, set at 10%, covering the most touristy areas of the Mediterranean coast.

Recently, Catalonia extended the reduced 5% rate for 35 years for first-time homebuyers, but increased the marginal rate to 13% for purchases over €1.5 million. The Valencian Community also offers discounts for young people and some families, but maintains the tax burden on the wealthiest, generating €1.5 billion in 2024, about 60% of the region's transfer tax revenues.

In France, transfer taxes are not particularly high, but the French assembly recently allowed local authorities to increase the rate by 0.5 percentage points, up to 5%. The real cost for French buyers is real estate commissions, which can reach 8% of the purchase price, compared to 3% in Germany and Italy and virtually nonexistent in Spain and the United Kingdom.

In Belgium, the standard registration tax is 12%, but regional governments have used their resources to reduce the tax burden. In Flanders, the rate fell to 2% in 2022 for first-time home buyers, while in Brussels, the first €200,000 of a home's value will be exempt from registration tax in 2023.