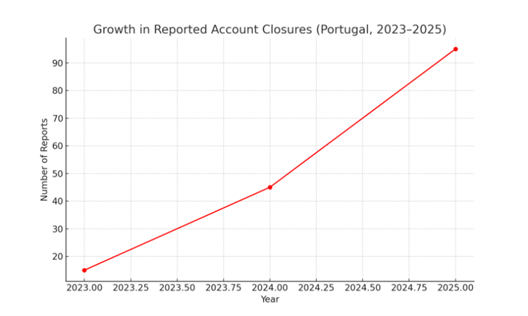

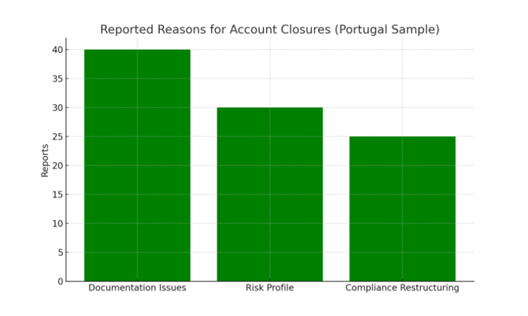

Forum data collected between 2023 and 2025, based on discussions on OffshoreCorpTalk, reveals a steady rise in reports of bank account closures, difficulties accessing international transfers, and reliance on electronic money institutions (EMIs). These issues are not confined to offshore centres or developing economies. They now affect entrepreneurs in Lisbon, freelancers in Porto, and retirees along the Algarve.

Small and medium-sized enterprises (SMEs), many of which power Portugal’s export economy, are increasingly vulnerable. A flagged cross-border transaction can mean weeks of delay. For expats, even routine transfers, from pensions to property payments, may face scrutiny.

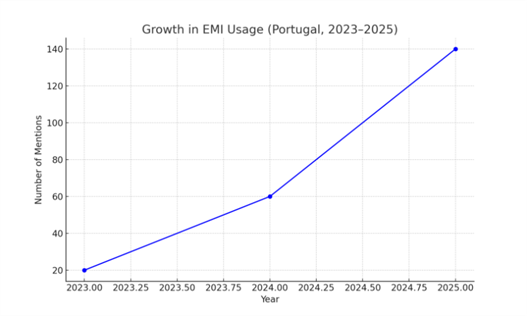

As banks retreat, fintech providers and EMIs are stepping in. Forum discussions show that reliance on these platforms has surged since 2023. For Portuguese SMEs, EMIs offer faster onboarding and international reach. Expats find them attractive for multi-currency accounts.

Yet these solutions come with caveats: higher fees, weaker consumer protections, and the absence of deposit insurance. For every entrepreneur who finds stability through an EMI, another reports concerns about long-term reliability.

Examples illustrate the human dimension. A tech startup in Porto lost access to its business account after expanding into African markets. An Algarve-based retiree described delays in transferring pension funds from the UK. A small exporter in Setúbal reported being cut off from traditional banks after increasing sales to Asia.

Portugal has positioned itself as a destination for entrepreneurs, freelancers, and investors through residency schemes such as the Non-Habitual Resident (NHR) programme and digital nomad visas. But these efforts risk being undermined if financial access cannot keep pace.

Unless reforms are introduced to balance compliance with accessibility, SMEs and expats may increasingly turn to informal or less regulated alternatives, an outcome that undermines the very compliance goals de-risking was meant to achieve.

Portugal’s future as a hub for global talent and investment depends not only on visas and tax policy but also on access to basic financial services. These findings, derived from OffshoreCorpTalk discussions during 2023–2025, highlight how account closures, payment delays, and reliance on EMIs are shaping Portugal’s financial landscape.

Using OffshoreCorpTalk, a scam forum, as a source is ridiculous. That forum is widely known as defrauding users and selling them useless or even illegal (and dangerous) solutions.

By JohnnyDoe from Other on 17 Sep 2025, 10:38